All Categories

Featured

Table of Contents

If you're somebody with a low tolerance for market fluctuations, this understanding could be vital - IUL growth strategy. Among the crucial aspects of any kind of insurance coverage policy is its cost. IUL plans typically come with numerous charges and charges that can affect their total value. An economic consultant can break down these costs and aid you evaluate them against various other low-cost investment choices.

Do not simply consider the costs. Pay certain interest to the policy's features which will certainly be very important depending upon how you wish to utilize the policy. Talk to an independent life insurance policy representative who can aid you select the most effective indexed global life policy for your needs. Total the life insurance application in complete.

Evaluation the policy carefully. If adequate, return signed shipment receipts to get your global life insurance protection in force. Make your first costs repayment to activate your plan. Now that we have actually covered the advantages of IUL, it's crucial to recognize just how it contrasts to various other life insurance policy plans readily available on the market.

By understanding the resemblances and distinctions between these plans, you can make a more educated decision regarding which kind of life insurance is ideal fit for your requirements and monetary objectives. We'll begin by comparing index universal life with term life insurance, which is commonly thought about one of the most uncomplicated and budget friendly kind of life insurance coverage.

Who provides the best Iul Companies?

While IUL may offer greater prospective returns as a result of its indexed cash money worth development mechanism, it also features greater costs compared to label life insurance policy. Both IUL and entire life insurance policy are sorts of irreversible life insurance policy plans that supply death advantage defense and money value growth possibilities (IUL premium options). There are some crucial differences between these two types of policies that are vital to think about when making a decision which one is best for you.

When thinking about IUL vs. all various other kinds of life insurance policy, it's crucial to consider the pros and cons of each plan kind and seek advice from with a seasoned life insurance representative or economic adviser to identify the very best choice for your special needs and monetary goals. While IUL offers numerous advantages, it's likewise vital to be knowledgeable about the risks and factors to consider linked with this type of life insurance policy policy.

Let's dive deeper into each of these risks. Among the main worries when taking into consideration an IUL plan is the different costs and costs associated with the policy. These can consist of the expense of insurance coverage, plan fees, surrender charges and any type of additional biker prices sustained if you include additional benefits to the policy.

Some may provide a lot more competitive prices on insurance coverage. Check the financial investment options readily available. You desire an IUL plan with a range of index fund choices to satisfy your demands. See to it the life insurance provider aligns with your personal economic goals, requirements, and threat resistance. An IUL plan ought to fit your certain circumstance.

Why should I have Iul Policy?

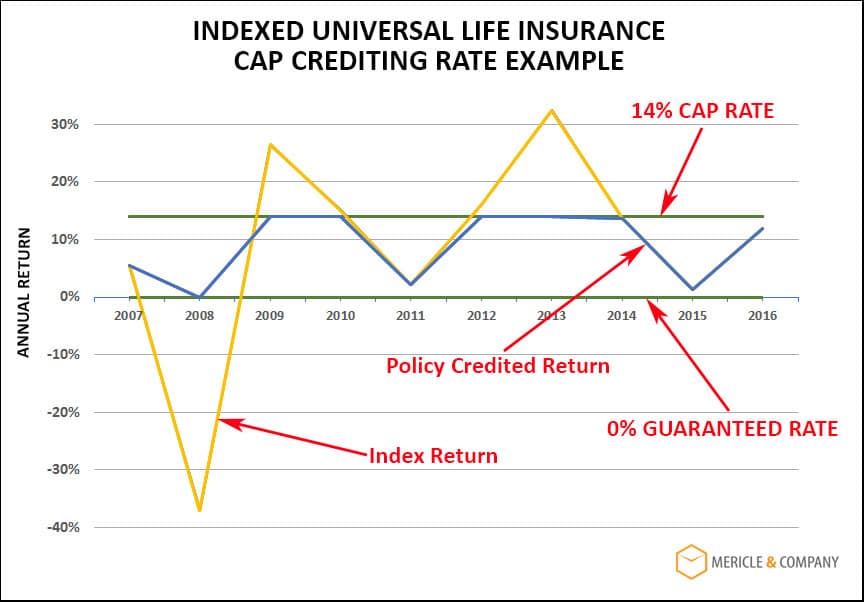

Indexed global life insurance can give a number of benefits for policyholders, including versatile premium repayments and the possible to earn higher returns. Nevertheless, the returns are restricted by caps on gains, and there are no guarantees on the market performance. All in all, IUL plans offer several prospective benefits, yet it is crucial to recognize their dangers also.

Life is not worth it for lots of people. It has the potential for big investment gains yet can be uncertain and expensive compared to conventional investing. Additionally, returns on IUL are normally reduced with significant charges and no assurances - IUL companies. Generally, it relies on your requirements and objectives (IUL plans). For those looking for predictable long-lasting cost savings and ensured survivor benefit, entire life might be the far better option.

How do I apply for Iul Death Benefit?

The advantages of an Indexed Universal Life (IUL) policy include prospective greater returns, no disadvantage threat from market movements, defense, adaptable repayments, no age need, tax-free survivor benefit, and funding accessibility. An IUL plan is irreversible and provides money worth growth through an equity index account. Universal life insurance policy began in 1979 in the USA of America.

By the end of 1983, all significant American life insurance providers offered universal life insurance policy. In 1997, the life insurance provider, Transamerica, introduced indexed universal life insurance policy which gave policyholders the ability to link policy growth with worldwide stock market returns. Today, universal life, or UL as it is also recognized is available in a range of various kinds and is a major component of the life insurance policy market.

The details given in this article is for educational and educational functions just and must not be understood as monetary or financial investment recommendations. While the author has experience in the subject matter, readers are advised to speak with a certified monetary expert before making any kind of investment decisions or acquiring any kind of life insurance coverage items.

Can I get High Cash Value Indexed Universal Life online?

As a matter of fact, you may not have believed much concerning how you want to invest your retired life years, though you most likely understand that you do not want to lack money and you wish to maintain your current way of life. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] < map wp-tag-video: Text appears alongside the company male talking with the cam that reads "company pension plan", "social safety and security" and "financial savings"./ wp-end-tag > In the past, people depended on 3 main sources of earnings in their retirement: a company pension, Social Security and whatever they 'd taken care of to save

Less employers are providing typical pension plan strategies. Also if benefits have not been reduced by the time you retire, Social Safety alone was never planned to be enough to pay for the way of living you want and are entitled to.

Prior to dedicating to indexed universal life insurance, below are some benefits and drawbacks to consider. If you pick a great indexed universal life insurance plan, you may see your cash worth grow in value. This is helpful due to the fact that you may have the ability to accessibility this cash prior to the strategy expires.

How do I get Long-term Indexed Universal Life Benefits?

Given that indexed universal life insurance coverage requires a specific level of risk, insurance firms often tend to maintain 6. This type of strategy likewise provides.

Lastly, if the selected index does not carry out well, your cash worth's growth will be influenced. Usually, the insurance provider has a beneficial interest in carrying out far better than the index11. However, there is typically an assured minimum interest price, so your strategy's growth won't fall below a specific percentage12. These are all factors to be thought about when choosing the very best sort of life insurance coverage for you.

Given that this type of policy is more intricate and has an investment element, it can usually come with higher premiums than various other plans like entire life or term life insurance coverage. If you don't think indexed universal life insurance coverage is best for you, below are some options to take into consideration: Term life insurance policy is a short-lived plan that generally uses protection for 10 to 30 years

Table of Contents

Latest Posts

Equity Index Life Insurance

Ffiul Insurance

Iul Vs Roth Ira

More

Latest Posts

Equity Index Life Insurance

Ffiul Insurance

Iul Vs Roth Ira